Jamestown (CSi) The Jamestown City Council met in Regular Session Monday evening at City Hall. Council Member Gumke was not present, at the outset and then later was in attendance.

Jamestown (CSi) The Jamestown City Council met in Regular Session Monday evening at City Hall. Council Member Gumke was not present, at the outset and then later was in attendance.

No bids were received for the sale of impounded/abandoned vehicles.

CONSENT AGENDA ITEMS CONSIDERED SEPARATELY INCLUDED

Item A was approved, unanimously, a Resolution to approve the request from the JSDC to act as a facilitator for CHS Fertilizer, for a new jobs training program and a 20 year agreement to provide $4,700,000 over 20 years ($235,000 annually) from the Economic Development Fund as an incentive grant to CHS Fertilizer, with the City Share to be $470,000 ($23,500 annually) and paid from the City Sales Tax Fund.

Item B. that was approved on a 3-2 vote, a Resolution to approve establishing the definition for affordable housing in the city to participate in the PACE Affordable Housing Program, to be equal to 80% of the median household income based on the 2010 census for Jamestown times 30% divided by 12, for a 2 bedroom apartment rental and utilities; with a 1 bedroom apartment rental to be $100 less and a 3 bedroom to be $100 more; subject to annual adjustment.

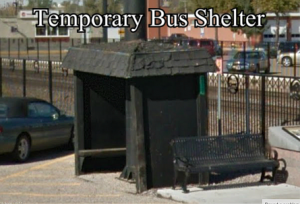

Item D A Resolution to deny the request for $16,000 to fund the construction of a Bus Shelter in the City parking lot west of the Post House. A City Council committee in September on a 3-1 vote with Council Member Buchanan not present recommended denying the funding, with Council Member Charlie Kourajian a supporter of the the proposed shelter, and the request, voted in opposition to the denial.

Since that meeting, an anonymous donor since identified by Charlie Kourajian as the Jamestown Knight’s of Columbus, has come forth to pay half of the request, or $8,000.

At Monday’s Meeting, Council Member Brubakken said the issue is about the city providing dollars and volunteer services, a for profit company, Jefferson Bus Lines, and if the bus line is making an effort to work with the city in constructing a shelter, and asking what their needs are. He questioned if Jefferson Bus Lines would also require additional amenities including providing staff.

Kourajian said a fourth wall to a shelter requires provisions be met in the building code including rest rooms, and ADA requirements. He pointed out supporters of the shelter are looking for economic development dollars put into the project from the City Sales Tax.

After further discussion and comments by Council members, the Council voted to deny the request of $16,000, on a 4-1 vote with Council Member Kourajian voted in opposition to the denial.

Item “E” A Resolution to acknowledge the findings of the City Attorney relative to responses received to the questionnaire pursuant to NDCC 40-57.1-03(5) regarding tax exemptions previously granted for Prairie Hills and the Heritage Centre relative to their assisted living services as meeting the terms of the approved tax exemptions.

A letter from Clarice Liechty was introduced into the record, that was E-Mailed to Council Members, as she was unable to attend the meeting.

Her testimony in part, concerned City Attorney Ken Dalsted in a July 31, 2014 letter to the City Council, which said “There is little in the way of documentation to discern the intent of the city in granting the specific exemptions. There are references to “Assisted Living Units in the applications, but nothing specifically committed to. We are checking to see if there are tapes of the meetings at which the developers were present to see what , if any commitments were made.”

Ms. Liechty’s testimony, said she reviewed a DVD recording, recorded by CSi Cable, of the August 25, 2009 City Council meeting, when Marvin Brown of Prairie Hills Apartments responded to the kind of services he would provide, including “transportation, food, nursing services, 2 meals which is standard, 24 hours emergency call, minimum of house cleaning once a week.”

Ms. Liechty said, “As for “Assisted Living Units” the license from the North Dakota Health Department applies only to the safety of the building and not the services provided.

The testimony went on to say, “Previously I (Clarice Liechty) have, both in verbal and written testimony, given this information to the city and the city council. She added that Brown’s testimony and assurances were the basis for his getting the tax exemption.

She said the request made to the City Council, earlier, was to request from Marvin Brown of Prairie Hills Apartments ” documentation” of what he is providing in services and if those services provided, match what he testified he would provide.

At Monday’s meeting, the City Council the Council voted unanimously to acknowledge the City Attorney’s findings.

ITEM M A Resolution was approved Change Order No. 1, to Hoffman & McNamara Company, for the East Business Loop Transportation Enhancement Project (TEU-2-987(038)042), for a net increase in the contract price of $25,464.00.

Item T was approved, a Resolution to approve Payment No. 2, to Woodsonia Real Estate Group, Inc., per the Developer Agreement dated August 8, 2013, in the amount of $4,000.00.

Approved without discussion.

Item C. that was approved, a Resolution to request a letter from Jamestown School District to discontinue the 1% City Sales Tax for the repayment of School District bonded indebtedness effective December 31, 2014, as it appears the district will have sufficient revenues to retire the bonds. The one percent City Sales Tax collection will continue through March 2015, the first quarter of the year, due to a mandated 90- day notification of ending the tax to the State Tax Department. The additional amount of taxes to be collected amounts to abour $500,000. Mayor Andersen said the city has not specifically ear-marked how the dollars will be allocated.

REGULAR AGENDA

RESOLUTIONS:

A PUBLIC HEARING was held, concerning the special assessment list for Paving, Water & Sewer Improvement District #13-42, #13-63 & #13-33.

The City Council approved the special assessments for Paving, Water & Sewer Improvement District #13-42, #13-63 & #13-33, in the total amount of $356,326.86, less the City Share of $33,532.90, less the Developer Fee of $58,000.00, with the balance of $264,793.96 to be assessed to benefited properties within the district.

A PUBLIC HEARING was held concerning the special assessment list for Sanitary Sewer District #13- 31 & #13-32.

Following the public hearing the City Council approved the special assessments for Sanitary Sewer District #13-31, in the total amount of $458,087.32, less the City Share of $114,521.83, with the balance of $343,565.49 to be assessed to benefited properties within the district; and also Sanitary Sewer District #13-32, in the total amount of $597,342.95, less the amended City Share of $162,102.78, with the balance of $435,240.17 to be assessed to benefited properties within the district.

A PUBLIC HEARING was held concerning the special assessment list for East Business Loop Reconstruction District #11-42, Project No. SU-2-987(029)033.

The City Council approved the special assessments for East Business Loop Reconstruction District #11-42, Project No. SU-2-987(029)033, in the total amount of $2,825,529.96, less the City Share of $2,186,864.56, with the balance of $638,665.40 to be assessed to benefited properties within the district.

Disapproved the application from Arctic Electric for a Special Use Permit to allow temporary sleeping rooms for employees on Lots 9-14, Block 7, Mill Hill 2nd Addition (Former Titan Building), which is currently zoned M-1 (Manufacturing District).

ORDINANCES:

A FIRST READING concerned an ordinance to amend Ordinance No. 329 by amending the District Map to change the zoning of Lots 1-7, Block 1, Scherbenske Third Estates Subdivision, from R-1 (Single Family Residential District) and A-1 (Agricultural District) to R-1(Single Family Residential District) and Lot 8, Block 1, Scherbenske Third Estates Subdivision, from R-1 (Single Family Residential District) and A-1 (Agricultural District) to A-1 (Agricultural District).

A FIRST READING concerned an ordinance to extend the City Sales Tax for economic development and city infrastructure fifteen (15) years to coincide with the Menard’s Tax Increment Financing District.

A FIRST READING concerned an ordinance to repeal Article IV of Chapter 25.5 pertaining to City Sales & Use Tax for school bond issue effective March 31, 2015.

HEARING FROM THE AUDIENCE: No one spoke.

APPOINTMENTS:

Council Member Brubakken was appointed to serve as the City Council representative on the South Central Dakota Regional Council with a term to expire September 2016.

OTHER BUSINESS:

(At 6:05 P.M.) PUBLIC HEARING was held Concerning the proposed budget for City General and Special Funds for the fiscal period January 1, 2015, through December 31, 2015.

A SECOND READING of an Ordinance pertaining to the appropriation of the Revenue and Special Funds for the fiscal year January 1, 2015, through December 31, 2015, was approved.

Mayor Andersen said the General Fund budget is “conservative,” noted that the city has approved the hiring of two additional police officers in 2015.

She noted more busget expenditures, in 2015, including utility projects.

The 2015 Jamestown City budget has a 1.9 percent increase over 2014, which will mean an increase in city property taxes.

City employees will receive a 2.5 percent increase in the step salary schedule, and a 2-percent cost of living salary increase.

The City Council directed the City Administrator to notify the County that the City of Jamestown should be exempt from the County Library Levy as the City maintains its own library levy.

The City Administrator was directed to certify the tax levies to the County for the fiscal period January 1, 2015, through December 31, 2015.

The City Council accepted and approved the 2013 City Audit, as prepared by Schauer & Associates, PC.

MAYOR AND COUNCIL MEMBER’S REPORT:

Mayor Andersen said the dedication of the fire fighters memorial will be held on Oct 8, 2014 at 5:30-p.m., in front of the City Fire Hall.

The meeting was shown live on CSi 67 followed by replays.

Comments are closed

Sorry, but you cannot leave a comment for this post.